In addition to all of the demographic and societal trends I have previously discussed regarding the demand and appeal of owning rental properties, here is another even more fundamental one: It is both much easier and cheaper to rent a home than to buy a home in the vast majority of all markets across the entire country.

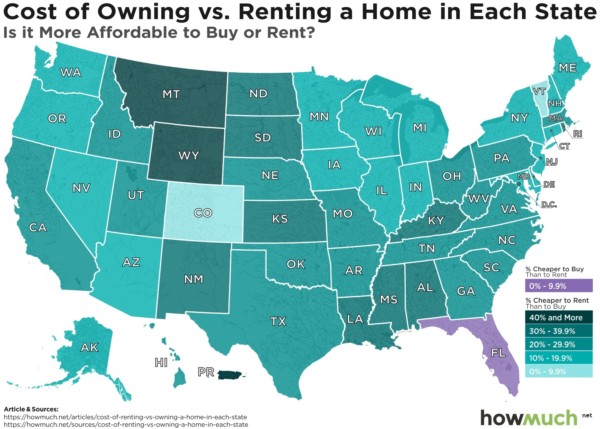

To help illustrate this disparity, HowMuch.net recently determined the average cost to rent a home vs. paying a mortgage on an average home in each of the 50 US states. Only Florida had a cheaper mortgage than rent. All 49 other states were better bargains to rent, from a monthly cash flow perspective.

It is important to note that this only compared rent to mortgage. In reality, the cost of home ownership is much higher than just a mortgage, which skews the numbers even more in favor of renting. A homeowner is responsible for all repairs, maintenance, and long term capital projects, whereas a tenant can frequently just make a call to the landlord and say “fix it” (at the landlord’s expense).

It is also worth noting that HowMuch.net’s analysis is primarily based just on those comparative monthly cash flow numbers. In reality, a homeowner can also receive longer term financial advantages of loan principal pay-down, appreciation, and tax deductions that are not available to renters. Nonetheless, the small initial and ongoing capital outlays for renting are very helpful to many people who need to rent since they have little savings plus they are paying other consumer + student debt.

There is much in the media about the high costs of rents across the country. However, in comparison to buying a home, providing rental homes (even more expensive rentals) is a necessary financial service for many people to be able to afford a good home.

This data also points to how difficult it can be in today’s market for a real estate investor to make any initial cash flow by investing in single family homes. For investors who still prefer SFR (single family residential), the investor’s answer generally lies in finding the occasional cheap or rehab home (needing considerable time and expense post-purchase), providing a large down payment to create low mortgage payments (resulting in low cash on cash return on investment), or investing in better cash flow markets such as some areas of the mid-west, south, and tertiary (smaller outlying) communities. From my perspective, the latter option of investing in the right cash flow market is the best answer. Anyone can put a lot of time and money in a home, or throw a lot of money at a purchase to keep mortgage payments low. As an investor, you want to optimize and maximize your use of time and capital, which is best done by buying in the markets that inherently already have the best returns baked in from the beginning.

My asset type preference remains with larger multi-family, since it also meets this financial societal need and is generally even more affordable to renters than single family homes. Multi-family is a larger scale business and can be purchased at prices that are driven more by a property’s true income stream. Single family home prices are more driven by what the neighboring comparable over-priced non-investment properties sold for recently, which has much less to do with its actual potential rental income stream.

Buy well, in the right market, and for cash flow. The demand from your customers – tenants – is out there and it is currently strong.

Leave A Comment